New vehicle sales started 2024 where they left 2023 off: with the choke on waiting for conditions and performance to improve.

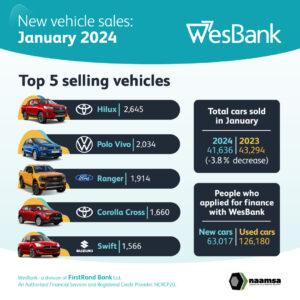

According to figures released by naamsa | the Automotive Business Council, new vehicle sales started on a weak footing, albeit with bigger volumes than December. January sales registered 41,636 new vehicles, 3,2% ahead of December sales; but 3,8% down year-on-year.

“January’s weaker performance continued the trend in declining year-on-year sales the market has experienced since August,” says Lebo Gaoaketse, Head of Marketing and Communication at WesBank. “But this performance should consider more realistic market figures to compare against the previous year than the skewed data since the pandemic years.”

But WesBank warned that economic headwinds remain a very real concern for household income and the motor industry at large. The Reserve Bank’s decision to hold interest rates in January will hopefully provide some stimulus to market activity. “Indebted consumers will have been relieved by the fourth consecutive hold on interest rates during January, which will continue to help buying power in the market and hopefully increase levels of demand as buying confidence restores,” says Gaoaketse.

South Africa’s new vehicle market managed to breach the 530,000 volume for 2023, the 0,5% growth flatter than anticipated and a real sign of the economic pressures being experienced in the country. But with five months of consecutive slow down in volumes towards the end of last year, along with a relatively softer January performance, the outlook for 2024 volumes looks lucky to show any growth at all.

The biggest losers in January sales were passenger cars, the largest share of new vehicle sales. Passenger cars lost 6,7% year-on-year, or 2,073 units to sell 28,790 units – more than the 1,658 total volume decline across the total market. The other sectors simply couldn’t recover the market losses, despite all but buses performing in positive territory. Light Commercial Vehicle sales increased 2,3% to 10,871 units.

“Motorists remain under pressure in the total mobility basket,” says Gaoaketse. “With interest rates stable, but still high, fuel price increases expected during February, consumer price inflation still on the high end of the target band, and elections looming, economic uncertainty is the reality for most households and businesses and potential new vehicle buyers will remain wary of big financial commitments.”

However, WesBank expects numerous opportunities to exist from efforts to stimulate demand in the market. “Banks may increase their risk appetite with lower quoted rates on deals to capture market share,” says Gaoaketse. “Brands and dealers will also be hungry to convert sales, offering enticing incentives that may provide an opportunity for the market to remain buoyant.”

..:: AUTO REPORT AFRICA ::..

..:: AUTO REPORT AFRICA ::..